The weakening world crude oil prices due to the strengthening US dollar is predicted to only have a temporary impact. Market participants tend to wait & see waiting for minutes of the Federal Open Market Committee that took place 30-31 January 2018. In trading Tuesday (30/1) at 16:30 pm, West Texas Intermediate (WTI) oil prices decreased 0.54 points or 0.82 % to US $ 65.02 per barrel on the New York Merchantile Exchange.

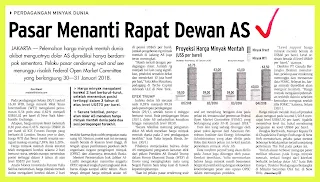

Brent oil prices fell 0.30 points, or 0.43 percent, to $ 69.16 a barrel on the London-based ICE Futures Europe exchange. Year to date, WTI and Brent prices are still up 7% and 3.20% respectively. The world's crude oil prices have been corrected for 2 consecutive days, after breaking the highest position in 3 years above the Ievel of US $ 70 per barrel.

Monex Investindo Futures analyst Yulia Safrina said the world's crude oil prices had a correction in the last 2 days as triggered by the strengthening of the US currency. However, current positions are still in the high-level range, as supply-limiting efforts by the Organization of Petroleum Exporting Countries (OPEC) and its allies include Russia.

Oil Minister Umar Al Luaibi said the majority of OPEC members agreed the stock cuts should be maintained until the end of the year. However, with US benchmark oil prices at US $ 65 per barrel, the number of crude oil rig drilling in US fields is also increasing.

"Still associated with dollar trading. The number of rigs becomes another significant thing, production is getting closer and closer to 10 million barrels per day, "said John Macaluso, a trader at Tyche Capital Advisors LLC in New York.

TRUMP EFFECT

The US dollar index rose 0.28% to 89.35% at the close of trading Monday (29/1), after falling 6 weeks in a row. In trading on Tuesday (30/1), the US dollar continued to rise to touch the level of 8959.

"Technically, the strengthening of the US dollar has pushed world oil prices on the last two trading sessions," said Yulia. It explains that the US dollar is strengthening because of the effects of US President Donald Trump's speech at the World Economic Forum (WEF) in Davos that wants Uncle Sam's currency to remain strong under his leadership.

"Currently market participants tend to wait and see ahead of a wide range of data this week, especially and the Federal Open Market Committee meeting HTOMCI held on 30-31 January 2018."

Other data being awaited by the market are reports from the American Petroleum Institute and the Energy Information Administration due for release on Wednesday and Thursday of last week on the amount of US shale oil inventories. Non-farm payroll data to be released on Friday is also awaited by the market.

Nevertheless, Yulia said that the price of oil still has the potential to move positively in line with expectations of market balance over OPEC's efforts to cut production.

"The level of crude oil price support is at US $ 60 per barrel. Resistance level is at the level of US $ 569 per barrel," he said.

Director of PT Garuda Berjangka Ibrahim said that market participants tend to wait and monitor FOMC data. After that, the price of oil is predicted to strengthen again.

"The price of oil weakened first before then strengthened after the release of FOMC," he said.

World crude oil prices are projected to strengthen in the quarter l / 2018 reached the level of US $ 67.50 per barrel. If it reaches that level, it will push the gains to the level of US $ 69 per barrel. Douglas Borthwick, Chief Manager of FX at Chapdelaine Foreign Exchange in New York, said market participants felt some uncertainty occurred ahead of the Fed's discovery this week.

"That's the biggest reason why the market sees pressure on crude oil prices, as the function of the correlation reverses against the US dollar," said Bob Yawger, Director of Futures Trading at Mizuho Securities USA Inc. in New York.

IN INDONESIA

Pasar Menanti Rapat Dewan AS

Pelemahan harga minyak mentah dunia akibat menguatnya dolar AS diprediksi hanya berdampak sementara. Pelaku pasar cenderung wait & see menunggu risalah Federal Open Market Comittee yang berlangsung 30-31 Januari 2018. Pada perdagangan Selasa (30/1) pukul 16.30 WIB, harga minyak West Texas Intermediate (WTI) mengalami penurunan 0,54 poin atau 0,82% menjadi US$ 65,02 per barel di New York Merchantile Exchange.

Adapun, harga minyak Brent melemah 0,30 poin atau 0,43% menuju US$ 69,16 per barel di ICE Futures Europe yangberbasis di London. Secara year to date, harga WTI dan Brent masih tercatat menguat masing-masing 7 38% dan 3,20%. Harga minyak mentah dunia tercatat telah mengalami koreksi selama 2 hari berturut-turut, setelah mampu menembus posisi tertinggi dalam 3 tahun di atas Ievel US$70 per barel.

Analis Monex Investindo Futures Yulia Safrina menuturkan, harga minyak mentah dunia mengalami koreksi dalam 2 hari terakhir karena dipicu oleh penguatan mata uang AS. Namun, posisi saat ini memang masih berada di kisaran level tinggi, di saat upaya pembatasan pasokan oleh organisasi negara pengekspor minyak (OPEC) dan aliansinya termasuk Rusia.

Menteri Perminyakan lrak Jabbar Al Luaibi mengatakan mayoritas anggota OPEC sepakat langkah pemangkasan stok harus dijaga sampai akhir tahun. Akan tetapi, dengan harga minyak acuan AS di posisi US$ 65 per barel, jumlah pengeboran rig minyak mentah di ladang AS juga terus meningkat.

“Masih terkait dengan perdagangan dolar. Jumlah rig menjadi hal lain yang signifikan, produksi semakin dekat dan mendekati 10 juta barel per hari," kata John Macaluso, pedagang di Tyche Capital Advisors LLC di New York.

EFEK TRUMP

Indeks dolar AS tercatat naik 0,28% menjadi 89,35% pada penutupan perdagangan Senin (29/1), setelah turun 6 minggu berturut-turut. Pada perdagangan Selasa (30/1), dolar AS melanjutkan kenaikan hingga menyentuh level 8959.

“Secara teknikal memang penguatan dolar AS telah menekan harga minyak memah dunia pada 2 sesi perdagangan terakhir,” kata Yulia. Pihaknya menjelaskan bahwa dolar AS mengalami penguatan karena efek dari pidato Presiden AS Donald Trump dalam Forum Ekonomi Dunia (WEF) di Davos yang menginginkan mata uang Negeri Paman Sam tetap kuat di bawah kepemimpinannya.

“Saat ini pelaku pasar cenderung wait and see menjelang beragam data pada pekan ini, terutama dan pertemuan Federal Open Market Committee HTOMCI yang berlangsung pada 30-31 Januari 2018.”

Data lain yang sedang ditunggu oleh pasar yakni laporan dari American Petroleum Institute dan Energy Infomation Administration yang akan dirilis pada Rabu dan Kamis pekan lalu, terkait jumlah persediaan minyak shale AS. Data nonfarm payroll yang akan dirilis pada Jumat juga ditunggu oleh pasar.

Kendati demikian, Yulia menuturkan bahwa harga minyak masih berpotensi bergerak positif seiring dengan ekspektasi keseimbangan pasar atas upaya OPEC dalam memangkas produksi.

“Level support harga minyak mentah berada di US$ 60 per barel Level resistan berada di level US$ 569 per barel” Ujarnya.

Direktur PT Garuda Berjangka lbrahim nenuturkan pelaku pasar cenderung menunggu dan memantau data FOMC. Selepas itu, harga minyak diprediksi akan menguat kembali.

“Harga minyak mengalami pelemahan terlebih dahulu sebelum kemudian menguat setelah rilis FOMC,” katanya.

Harga minyak mentah dunia diproyeksi akan menguat pada kuartal l/2018 mencapai level US$67,50 per barel. Apabila mencapai level itu, akan mendorong penguatan ke level US$ 69 per barel. Douglas Borthwick, Manajer Kepala FX di Chapdelaine Foreign Exchange di New York menuturkan, pelaku pasar merasa beberapa ketidakpastian terjadi menjelang penemuan The Fed pada pekan ini.

“ltulah alasan terbesar mengapa pasar melihat tekanan pada Harga minyak mentah, terkait fungsi dari korelasi berbalik terhadap dolar AS," kata Bob Yawger, Direktur Perdagangan Berjangka di Mizuho Securities USA lnc. di New York.

Bisnis Indonesia, Page-16, Wednesday, Jan 31, 2018

No comments:

Post a Comment