Addressing the industry's demand for lower gas prices, the government will issue new regulations to reduce gas prices for industries.

The head of the Bureau of Communications and Public Information Services of the Ministry of Energy and Mineral Resources (ESDM) Dadan Kusdiana said that it soon issued a regulation to fix gas prices calculated on the basis of several price-fixing components.

Some of these components consist of upstream gas prices, distribution costs, and natural gas distribution costs. The government has lowered the price of industrial gas for the region of North Sumatra. This matter is regulated in Minister of Energy and Mineral Resources Decree no. 434/2017 on Natural Gas Price in Medan Area and Surrounding Area. The gas price in the area fell from US $ 7.85 per MMBtu to US $ 6.95 plus 1% of the Indonesian crude price (ICP) per MMBTU.

"For other regions [other than North Sumatra], at the proposal of the Ministry of Industry, gas prices will be lowered. Currently, the government is preparing an EMR Ministerial Decree on the decline in industrial gas prices, "he said.

The Chairman of the Forum for Industrial Gas Users (FIPGB) Achmad Safiun said that the government needs to reduce the price of gas for the whole region, not only in North Sumatra. The price of gas borne by the industry varies depending on the region, the agreement with the contractor, and the incentives provided by the government.

He pointed out, currently the price of gas in West Java US $ 9.2 per MMBtu, and East Java US $ 8.2 MMBtu. Meanwhile, the Downstream Oil and Gas Regulatory Agency (BPH Migas) also has efforts to lower gas prices for industries. Head of BPH Migas Fansurullah Asa said that it will revise the tariff lease tariff (toll fee) in all gas pipelines. Currently, BPH Migas is still reviewing the decrease in the cost of renting the gas pipeline.

"This is one of our efforts to lower gas prices. However, the authority of industrial gas price decline is in the Ministry of Energy and Mineral Resources, "he said

Meanwhile, the gas user industry urged the government to immediately realize the reduction of gas price to US $ 6 per MMBtu, Achmad Safiun demanded that the government consistent with the pledge of natural gas price decline for seven industrial sectors, namely fertilizer, petrochemical, oleochemistry, steel, ceramics, glass , and rubber gloves.

WILL BE EFFECTIVE

He considered that the decline in gas prices would be effective to support the growth of the competitiveness of the seven diminishing industrial sectors.

"It has been more than a year since the Presidential Instruction on gas tariff reduction until now has not been done," Achmad said at a press conference on Monday (9/10).

According to him, at the beginning of 2015 the global oil price at that time reached US $ 100 per barrel fell to US $ 50. The same thing happened to the world's price of gas commodities that continue to decline. However, the decline in gas prices did not occur in the country because the gas tariff in Indonesia is still fixed, ie the average US $ 9 per MMBtu.

"This is what makes the cost of production up to the price of Indonesian manufacturer products is more expensive compared to other countries," he said.

FIPGB notes that the government has attempted to regulate gas prices since September 9, 2015 through a package of economic policies jilld I. The government at the time was considering the fixing of gas prices for certain domestic industries, then, the government reissued the economic policy package volume III on 7 October 2015 on gas price determination for industrial sector worth US $ 7 per MMBtu.

The price of gas refers to the fertilizer industry, while for other sectors will be decreased in accordance with the ability of each industry. The government also issued Presidential Regulation Number. 40/2016 on Natural Gas Price not higher than US $ 6 per MMBtu for seven priority industry sectors.

The beleid aims to enhance the competitiveness of national industries in the face of global markets. Achmad revealed that until now the price of gas borne by the industry varies depending on the region, agreements with contractors, and incentives.

He explained that the current price of gas in the region of North Sumatra reached US $ 9.95 per MMBtu, West Java US $ 9.2 per MMBtu, and East Java US $ 8.2 MMBtu.

He added that manufacturers such as ceramics, glass, and gloves are now facing difficulty in production. Meanwhile, the ceramic industry is hoping for a breakthrough from the government to help the manufacturing sales.

Elisa Sinaga, Chair of the Indonesian Ceramic Association (Asaki), said that the government should not only focus on reducing gas prices for industrial needs. However, it should pay attention to all aspects of other support for national products can be absorbed in local and global markets.

IN INDONESIA

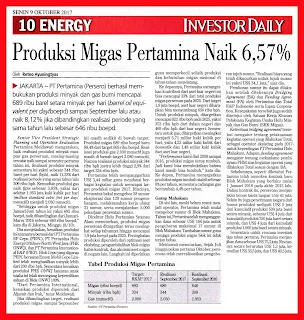

Pemangkasan Gas Segera Direalisasikan

Menyikapi tuntutan industri terhadap penurunan harga gas, pemerintah akan menerbitkan regulasi baru untuk menurunkan harga gas bagi industri.

Kepala Biro Komunikasi dan Iayanan Informasi Publik Kementerian Energi dan Sumber Daya Mineral (ESDM) Dadan Kusdiana mengatakan bahwa pihaknya segera menerbitkan regulasi untuk menetapkan harga gas yang dihitung berdasarkan beberapa komponen pembentuk harga.

Beberapa komponen itu terdiri atas harga gas bumi di hulu, biaya penyaluran, dan biaya distribusi gas bumi. Pemerintah telah menurunkan harga gas industri untuk wilayah Sumatra Utara. Hal ini diatur dalam Keputusan Menteri ESDM No. 434/2017 tentang Harga Gas Bumi di Wilayah Medan dan Sekitarnya. Harga gas didaerah itu, turun dari US$ 7,85 per MMBtu menjadi US$ 6,95 ditambah 1% dari harga minyak (Indonesian crude price/ICP) per MMBTU.

“Untuk wilayah lainnya [selain Sumatra Utara], atas usulan Kementerian Perindustrian, harga gas akan diturunkan. Saat ini, pemerintah sedang menyusun Keputusan Menteri ESDM tentang penurunan harga gas industri,” katanya.

Ketua Forum Industri Pengguna Gas Bumi (FIPGB) Achmad Safiun mengatakan bahwa pemerintah perlu menurunkan harga gas untuk seluruh wilayah, tidak hanya di Sumatra Utara. Harga gas yang ditanggung oleh industri berbeda-beda tergantung dari wilayah, perjanjian dengan kontraktor, dan insentif yang diberikan oleh pemerintah.

Dia mencontohkan, saat ini harga gas di Jawa Barat US$ 9,2 per MMBtu, dan Jawa Timur US$ 8,2 MMBtu. Sementara itu, Badan Pengatur Hilir Minyak Bumi dan Gas (BPH Migas) juga mempunyai upaya untuk menurunkan harga gas untuk industri. Kepala BPH Migas Fansurullah Asa mengatakan bahwa pihaknya akan merevisi tarif sewa pipa (toll fee) di seluruh jaringan pipa gas. Saat ini, BPH Migas masih mengkaji penurunan biaya sewa pipa gas.

“Ini adalah salah satu upaya kita untuk menurunkan harga gas. Namun, wewenang penurunan harga gas industri ada di Kementerian ESDM," katanya

Sementara itu, industri pengguna gas mendesak agar pemerintah segera merealisasikan penurunan harga gas menjadi US$ 6 per MMBtu, Achmad Safiun menuntut agar pemerintah konsisten terhadap janji penurunan harga gas bumi untuk tujuh sektor industri, yaitu pupuk, petrokimia, oleokimia, baja, keramik, kaca, dan sarung tangan karet.

AKAN EFEKTIF

Dia menilai bahwa penurunan harga gas akan efektif untuk mendukung pertumbuhan daya saing ketujuh sektor industri yang sedang redup itu.

“Sudah terhitung lebih dari setahun, sejak Instruksi Presiden mengenai penurunan tarif gas sampai saat ini belum terlaksana,” kata Achmad saat konferensi pers, Senin (9/10).

Menurutnya, pada awal 2015 harga minyak global yang saat itu mencapai US$ 100 per barel turun menjadi US$ 50. Hal yang sama terjadi pada harga komoditas gas dunia yang terus menurun. Namun, penurunan harga gas itu tidak terjadi di Tanah Air karena tarif gas di Indonesia terbilang masih tetap, yaitu rerata US$ 9 per MMBtu.

“Ini yang membuat ongkos produksi sampai dengan harga produk pabrikan Indonesia lebih mahal dibandingkan dengan negara lain,” ujarnya.

FIPGB mencatat bahwa pemerintah telah berupaya untuk memberikan regulasi mengenai harga gas sejak 9 September 2015 melalui paket kebijakan ekonomi jilld I. Pemerintah pada saat itu mempertimbangkan tentang penetapan harga gas untuk industri tertentu dalam negeri, kemudian, pemerintah menerbitkan kembali paket kebijakan ekonomi jilid III pada 7 Oktober 2015 tentang penetapan harga gas untuk sektor industri senilai US$ 7 per MMBtu.

Harga gas tersebut mengacu pada industri pupuk, sedangkan untuk sektor lain akan diturunkan sesuai dengan kemampuan industri masing-masing. Pemerintah juga menerbitkan Peraturan Presiden Nomor. 40/2016 tentang Harga Gas Bumi tidak lebih tinggi dari US$ 6 per MMBtu untuk tujuh sektor industri prioritas.

Beleid itu bertujuan untuk meningkatkan daya saing industri nasional dalam menghadapi pasar global. Achmad mengungkapkan bahwa sampai saat ini harga gas yang ditanggung oleh industri berbeda-beda tergantung dari wilayah, perjanjian dengan kontraktor, dan insentif.

Dia menjelaskan, saat ini harga gas di wilayah Sumatra Utara mencapai US$ 9,95 per MMBtu, Jawa Barat US$ 9,2 per MMBtu, dan Jawa Timur US$ 8,2 MMBtu.

Dia menambahkan bahwa pabrikan seperti keramik, kaca, dan sarung tangan kini sedang menghadapi kesulitan dalam berproduksi. Sementara itu, industri keramik mengharapkan adanya terobosan dari pemerintah untuk membantu penjualan manufaktur tersebut.

Elisa Sinaga, Ketua Umum Asosiasi Aneka Keramik Indonesia (Asaki), menyampaikan bahwa pemerintah tidak perlu hanya terfokus pada penurunan harga gas untuk kebutuhan industri. Namun, harus memperhatikan segala aspek pendukung lain agar produk nasional dapat terserap di pasar lokal maupun global.

Bisnis Indonesia, Page-30, Tuesday, October 10, 2017