Production ready to sell national oil and gas is 1.91 million barrels of oil equivalent per day (BOEPD) or reaches 95% of the 2018 state budget target. On the other hand, production is ready to sell (lifting) oil at 762,000 barrels per day (bpd), and natural gas 1.14 million BOEPD.

Spokesperson for the Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) Wisnu Prabawa Taher hopes that until the end of the year oil and gas production can be maximized. Regarding production performance, he said that the influence of new well performance was not in line with expectations, coupled with the decline in the rate of existing wells that were getting bigger.

There are several operating and instrument constraints but they can be overcome. Then there are several development programs that are retreating to next year, "he said.

In order to develop the upstream oil and gas field and maintain production optimization, he added, SKK Migas said that it had drilled the development of 251 wells and targeted 289 wells. Meanwhile, the work program for the S54 wells is reset or from the target of 636 wells. Gradually, Wisnu stated that his party still strives to achieve maximum results.

Reflecting on the investment realization up to 31 October 2018 worth US $ 8.7 billion or 61% of this year's target, SKK Migas said that there is not much potential for the future.

According to him, one of the causes of the low realization of oil and gas investment in 2018 was because the exploration and exploitation drilling was canceled. However, he considered the realization would be done next year. Although not the only inhibiting factor, Wisnu stated, the drilling shift has a significant impact. In the future, SKK Migas claims that it will be more committed to guarding the realization of exploration.

the Gajah Puteri Bison Iguana Block

In 2019, the main upstream oil and gas project which was planned to produce only came from the Gajah Puteri Bison Iguana Block. Production from the oil and gas field located in Riau Islands will be carried out in the third / 2019 quarter.

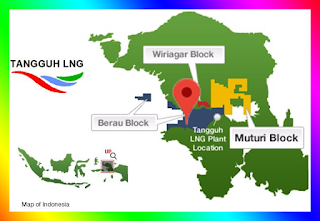

Tangguh Train-3 Block Papua

If next year oil and gas investment is relatively stagnant, he assessed, the investment plan in 2020 will be more attractive. The reason is that there are four oil and gas blocks that will start production. He explained, the Badik and West Badik Blocks will operate in the third quarter of 2020 which is now in the development of the FEED tender, Tangguh Train-3 Block (quarter III / 2020) which is in the construction phase, Wasambo Block (quarter IV / 2020) in the FEED process, and the MDA and MBH Blocks for HCML working areas which are planned to produce in the third quarter of 2020.

the MDA and MBH Blocks by HCML

In terms of state revenues, Wisnu said that until November 2018 at least the realization reached US $ 15.9 billion or 133% of the state budget target. According to him, the figure can change until it is waiting for realization until the end of the year. With the increase in world oil prices, he projects there is a potential for increased state revenues.

In terms of cost recovery realization until the end of November this year, Wisnu stated that it had reached US $ 10.9 billion or had exceeded the target of the 2018 State Budget (APBN) of US $ 10.1 billion.

"That's an unaudited number," he said.

Previously, SKK Migas projected the realization of the return on operating costs to reach US $ 11.7 billion or 112% of the 2018 State Budget target. SKK Migas has a strategy so that the return on operating costs can be in line with the APBN target, especially in the 2019 Draft State Budget.

Wisnu added that his party would see the details of the compensation component by using cost benchmarking, so that the estimated cost in 2019 could be obtained which was more accurate and economical. In addition, the use of shared assets can be more optimal in operating costs.

"Optimizing time in carrying out activities in the field, especially in drilling activities, reworking wells and maintenance," he added.

PERTAMINA EP

On the other hand, President Director of PT Pertamina EP Nanang Abdul Manaf projects oil production by the end of the year to reach 79,000 barrels per day (bpd) or 96% of the 2018 target, while gas production will be realized at 1,019 MMSCFD or 103% of the 2018 target.

According to him, oil production did not reach the target due to finalization of drilling for wells this year is still ongoing and cannot yet produce

.

"Because the wells targeted are finished 90, the realization is still 74 and 14 are still on going," he said.

Oil lifiting was recorded at 78,120 bpd or 98% of this year's target. Gas lifting is recorded at 815 MMSCFD or 105% of this year's target. From the prognosis to the end of the year, Nanang said the realization of the achievement of profit could exceed the target.

"Because it is helped by oil prices above the previous forecast," he said.

Pendopo Field Plaju-Palembang

Obstacles meet the target due to non-fulfillment of drilling, covered with the performance of several fields managed by Pertamina EP such as the performance of Pendopo Field. As one of the production backbone in Pertamina EP, He explained Pendopo Field contributed gas amounting to 261.04 MMSCFD or 110.2% of the 243.16 MMSCFD target.

IN INDONESIAN

Lifting Migas Capai 95% dari Target

Produksi siap jual minyak dan gas nasional tercatat 1,91 juta barrel oil equivalent per day (BOEPD) atau mencapai 95% dari target APBN 2018. Di sisi lain, produksi siap jual (lifting) minyak bumi sebesar 762.000 barel per hari (bph), dan gas bumi 1,14 juta BOEPD.

Juru Bicara Satuan Kerja Khusus Pelaksana Kegiatan Usaha Hulu Minyak dan Gas Bumi (SKK Migas) Wisnu Prabawa Taher berharap hingga akhir tahun produksi migas dapat lebih maksimal. Terkait dengan performa produksi, dia mengatakan bahwa pengaruh kinerja sumur yang baru belum sesuai dengan ekspektasi, ditambah dengan decline rate dari sumur eksis yang semakin besar.

Ada beberapa kendala operasi dan instrumen namun sudah dapat diatasi. Kemudian ada beberapa program pengembangan yang mundur ke tahun depan,” katanya.

Dalam rangka mengembangkan lapangan hulu migas dan menjaga optimasi produksi, imbuhnya, SKK Migas menyatakan telah melakukan pengeboran pengembangan 251 sumur dan target 289 sumur. Sementara itu, program kerja ulang atau workouer S54 sumur dari target 636 sumur. Secara bertahap, Wisnu menyatakan pihaknya tetap mengupayakan pencapaian bisa maksimal.

Berkaca dari realisasi investasi hingga 31 Oktober 2018 senilai US$ 8,7 miliar atau 61% dari target tahun ini, SKK Migas menyebutkan potensi ke depan tidak banyak perubahan.

Menurutnya, salah satu penyebab rendahnya realisasi investasi migas pada 2018 karena pergesaran pengeboran ekplorasi dan eksploitasi yang batal dilaksanakan. Namun, dia menilai realisasinya akan dilakukan tahun depan. Walaupun bukan satu-satunya faktor penghambat, Wisnu menyatakan,

pergeseran pengeboran berdampak signifikan. Pada masa mendatang, SKK Migas mengaku akan lebih berkomitmen untuk mengawal realiasi ekplorasi.

Pada 2019, proyek utama hulu migas yang rencananya berproduksi hanya datang dari Blok Bison Iguana Gajah Puteri. Produksi dari lapangan migas yang terletak di Kepulauan Riau ini akan dilaksanakan pada kuartal III/2019.

Apabila pada tahun depan investasi migas relatif stagnan, dia menilai, rencana penanaman modal pada 2020 akan lebih menarik. Alasannya, ada empat blok migas yang akan mulai berproduksi. Dia memaparkan, Blok Badik dan West Badik akan beroperasi kuartal III/2020 yang kini dalam perkembangan tender FEED, Blok Tangguh Train-3 (kuartal III/2020) yang berada pada tahap konstruksi, Blok Wasambo (kuartal IV/2020) dalam proses FEED, serta Blok MDA dan MBH wilayah kerja HCML yang rencananya berproduksi pada kuartal III/2020.

Dari sisi penerimaan negara, Wisnu mengatakan hingga November 2018 setidaknya realisasinya mencapai US$ 15,9 miliar atau 133% dari target APBN. Menurutnya, angka tersebut dapat berubah sampai menunggu realisasi hingga akhir tahun. Dengan meningkatnya harga minyak dunia, dia memproyeksikan ada potensi peningkatan penerimaan negara.

Dari sisi realisasi cost recovery hingga akhir November tahun ini, Wisnu menyatakan telah mencapai US$ 10,9 miliar atau sudah melebihi target Anggaran Pendapatan dan Belanja Negara (APBN) 2018 sebesar US$10,1 miliar.

“Itu angka unaudited," katanya.

Sebelumnya, SKK Migas memproyeksi realisasi pengembalian biaya operasi akan mencapai US$ 11,7 miliar atau 112% dari target APBN 2018. SKK Migas memiliki strategi agar pengembalian biaya operasi bisa sesuai dengan target APBN, khususnya dalam Rancangan APBN 2019.

Wisnu menambahkan pihaknya akan melihat detail kompenen biaya dengan penggunaan cost benchmarking, sehingga dapat diperoleh estimasi biaya pada 2019 yang lebih akurat dan ekonomis. Selain itu, pemanfaatan aset bersama bisa lebih optimal dalam biaya operasi.

"Optimalisasi waktu dalam pelaksanaan kegiatan di lapangan, terutama dalam kegiatan pemboran, kerja ulang sumur dan maintanance,” tambahnya.

PERTAMINA EP

Di pihak lain, Presiden Direktur PT Pertamina EP Nanang Abdul Manaf memproyeksikan produksi minyak hingga akhir tahun mencapai 79.000 barel per hari (bph) atau 96% dari target 2018, sedangkan produksi gas akan terealisasi sebesar 1.019 MMSCFD atau 103% dari target 2018.

Menurutnya, produksi minyak tidak mencapai target akibat finalisasi pengeboran sumur tahun ini masih berlangsung dan belum dapat berproduksi

.

“Karena sumur yang ditargetkan selesai 90, realisasinya masih 74 dan 14 masih on going,” katanya.

Untuk lifiting minyak tercatat sebesar 78.120 bph atau 98% dari target tahun ini. Untuk lifting gas tercatat 815 MMSCFD atau 105% dari target tahun ini. Dari prognosa hingga akhir tahun, Nanang menyatakan realisasi pencapaian laba dapat melebihi target.

“Karena dibantu harga minyak di atas forecast sebelumnya" katanya.

Hambatan memenuhi target akibat tidak terpenuhinya pengeboran, tertutupi dengan kinerja beberapa lapangan yang dikelola Pertamina EP seperti kinerja dari Pendopo Field. Sebagai salah satu backbone produksi di Pertamina EP, Dia menjelaskan Pendopo Field memberikan kontribusi gas sebesar 261,04 MMSCFD atau 110,2% dari target 243,16 MMSCFD.

Bisnis Indonesia, Page-24, Friday, Dec 14, 2018