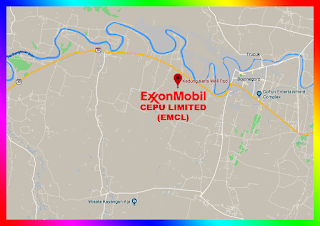

ExxonMobil Cepu Limited (EMCL) commenced the operation of the Kedung Keris Field, Cepu Block with peak production of 10 thousand barrels per day (BPD). This field will strengthen the position of the Cepu Block as the largest oil producer in Indonesia, shifting the position of the Rokan Block which is worked on by PT Chevron Pacific Indonesia (CPI).

PT Chevron Pacific Indonesia (CPI)

Cepu, we have increased oil production. Hopefully next year there will be an additional 10 thousand BPD, so the difference in production will be further increased compared to Rokan, "said Head of the Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) Dwi Soetjipto when inaugurating the operation of the Kedung Keris Field.

The Rokan Block

The Rokan Block currently produces around 190 thousand BPD of oil. While Cepu Block's production is around 219 thousand BPD. Next year, the production of the Rokan Block is projected to fall because before the contract expires. On the contrary, oil production from the Cepu Block is getting higher with the operation of the Kedung Keris Field.

Louise McKenzie

The existence of the Kedung Keris project can even increase the production of the Cepu Block to 235 thousand BPD. ExxonMobil Cepu Limited President Louise McKenzie added that the Kedung Keris Field had been producing oil since November 22, ahead of schedule. At present oil production from this field is still around 5,000 BPD and will increase gradually until it reaches a peak of 10,000 BPD.

the Cepu Block

"This production will help maintain the average production of the Cepu Block which currently produces more than 25% of the national oil production which also makes ExxonMobil the number one oil producer in Indonesia," Louise McKenzie said.

EPC Kedung Keris Field Bojonegoro

The Engineering, Procurement, and Construction (EPC) contract of the Kedung Keris Project was carried out by PT Meindo Elang Indah, a local Indonesian company. The project with an investment value of US $ 76 million consists of a well site for the operation of one well and an 8-inch 8-inch underground pipeline connected to the Banyu Urip Central Processing Facility.

Kedung Keris Field BY EXXONMOBIL

Kedung Keris Field was discovered in 2011, about 15 kilometers east of the Banyu Urip Field. Based on the current evaluation, oil reserves from the Kedung Keris Field are estimated to reach 20 million barrels of oil. The two fields are located in the Cepu Block, where ExxonMobil Cepu Limited acts as the operator.

Dwi Soetjipto

Dwi continued, from the maximum production trial results, the Cepu Block production facility could produce oil up to 235 thousand BPD in safe conditions. However, the increase in production of the Cepu Block is still awaiting approval of the revised Environmental Impact Analysis (EIA). The reason is that the Amdal currently only lists a maximum production of 220 thousand BPD. Therefore, he hopes the local government can help facilitate the provision of EIA recommendations related to changes in production figures.

"It was concluded that production of 235 thousand BPD was in a safe position. Now how do we get permission to operate at that level," Dwi said.

the Banyu Urip Field

It will continue to help ExxonMobil to continue to increase production and increase exploration. As long as the Amdal revision approval has not yet been obtained, oil production from the Banyu Urip Field must be reduced following the operation of the Kedung Keris Field. This is so operating activities Cepu Block does not violate the existing EIA.

Oil production from the two fields can only be optimized after the new AMDAL is approved. Thus, his party could not be sure when the Kedung Keris Field reached peak production. However, the production of the Cepu Block did not necessarily be boosted to reach 235 thousand BPD.

"When we operate [Cepu Block], we will pay attention to various things, including facilities, reservoirs, etc. For running at 235 thousand BPD, it is not certain. We must pay attention to everything," Dwi said.

McKenzie added, the EIA approval process was still in progress. Not long ago, it has held a technical study with the Ministry of Environment and Forestry (KLHK). Furthermore, his party will carry out community studies.

"This process has many stages, but it is hoped that [EIA] will come out within a month or two," he said.

Strengthen the Region

According to Dwi, the operation of the Kedung Keris Field will generate a gross income of around Rp 3.3 trillion per year. But not only that, if it continues, this gross income will also contribute to the economic conditions of the country and the region. In addition, increasing oil and gas production in the East Java region is also important to meet the energy needs in this region. Because the industry in East Java is growing very high.

After East Java has become the largest oil-producing region in Indonesia, it will also boost gas production in this region. At present oil production in this region reaches more than 25% of national production.

"We are making arrangements to be able to meet the needs of gas in East Java, there are projects in the Madura Strait. So we emphasize to meet the needs of East Java. Hopefully, it will not disturb investors in East Java," Dwi said.

The Head of the East Java Office of Energy and Mineral Resources (ESDM) Setiaji appreciated the commencement of oil production from the Kedung Keris Field. Moreover, this operation boosts oil production in its region to 305 thousand BPD. The realization of this production reaches around more than 30% of national production.

He hopes that if there are still new fields that can be offered, the company can work on the oil and gas field. This is to encourage oil and gas production in East Java. On the contrary, it promises convenience for oil and gas companies.

"Maybe there are new licenses and Amdal, if there are difficulties, we ask that we can come and we will facilitate and speed up," said Setiaji.

Referring to SKK Migas data, this year, Cepu Block oil lifting is targeted at 216 thousand BPD. Until the end of September, the realization of Cepu Block oil lifting has exceeded the target, which is 216,011 thousand BPD. This Cepu Block oil production increased compared to the end of last year of 209 thousand BPD.

Meanwhile, the amount of reserves that can be produced (recoverable reserve) in the Cepu Block is currently recorded at 823 million barrels. This reserve is higher than initially estimated in the development plan (POD) of 450 million barrels.

IN INDONESIA

Proyek Kedung Keris Jadikan Blok Cepu Penghasil Minyak Terbesar

ExxonMobil Cepu Limited (EMCL) memulai pengoperasian Lapangan Kedung Keris, Blok Cepu dengan puncak produksi 10 ribu barel per hari (bph). Lapangan ini akan memperkuat posisi Blok Cepu sebagai penghasil minyak terbesar di Indonesia, menggeser posisi Blok Rokan yang digarap PT Chevron Pacific Indonesia (CPI).

Cepu, kita punya produksi minyak meningkat. Semoga tahun depan bisa tambahan 10 ribu bph maka bedanya produksi semakin jauh meningkat dibandingkan Rokan," kata Kepala Satuan Kerja Khusus Pelaksana Kegiatan Usaha Hulu Minyak dan Gas Bumi (SKK Migas) Dwi Soetjipto ketika meresmikan beroperasinya Lapangan Kedung Keris.

Blok Rokan saat ini memproduksi minyak sekitar 190 ribu bph. Sementara produksi Blok Cepu sekitar 219 ribu bph. Tahun depan, produksi Blok Rokan diproyeksikan turun lantaran menjelang kontrak berakhir. Sebaliknya, produksi minyak dari Blok Cepu semakin tinggi dengan telah beroperasinya Lapangan Kedung Keris.

Keberadaan proyek Kedung Keris bahkan bisa meningkatkan produksi Blok Cepu sampai 235 ribu bph. Presiden ExxonMobil Cepu Limited Louise McKenzie menambahkan, Lapangan Kedung Keris telah menghasilkan minyak sejak 22 November lalu, lebih cepat dari jadwal. Saat ini produksi minyak dari lapangan ini masih sekitar 5 ribu bph dan akan naik bertahap hingga mencapai puncak produksi 10 ribu bph.

"Produksi ini akan membantu mempertahankan rata-rata produksi Blok Cepu yang saat ini menghasilkan minyak lebih dari 25% dari produksi minyak nasional yang juga menjadikan ExxonMobil produsen minyak nomor satu di Indonesia," Kata Louise McKenzie.

Kontrak rekayasa, pengadaan dan konstruksi (engineering, procurement, and construction/EPC) Proyek Kedung Keris dilaksanakan PT Meindo Elang Indah, perusahaan lokal Indonesia. Proyek dengan nilai investasi US$ 76 juta terdiri dari tapak sumur untuk operasi satu sumur dan pipa bawah tanah berdiameter 8 inch sepanjang 15 kilometer yang tersambung dengan Fasilitas Pengolahan Pusat Banyu Urip.

Lapangan Kedung Keris ditemukan pada 2011, sekitar 15 kilometer sebelah timur Lapangan Banyu Urip. Berdasarkan evaluasi saat ini, diperkirakan cadangan minyak dari Lapangan Kedung Keris mencapai 20 juta barel minyak. Kedua lapangan tersebut terletak di Blok Cepu, di mana ExxonMobil Cepu Limited bertindak sebagai operator.

Dwi melanjutkan, dari hasil uji coba produksi maksimal, fasilitas produksi Blok Cepu bisa menghasilkan minyak hingga 235 ribu bph dalam kondisi aman. Namun, peningkatan produksi Blok Cepu ini masih menunggu persetujuan revisi Analisis Dampak Lingkungan (Amdal). Pasalnya, Amdal yang ada saat ini hanya mencantumkan produksi maksimal sebesar 220 ribu bph. Karenanya, pihaknya berharap pemerintah daerah setempat dapat membantu mempermudah pemberian rekomendasi Amdal terkait perubahan angka produksi tersebut.

"Disimpulkan produksi 235 ribu bph dalam posisi aman. Sekarang bagaimana kita mendapat izin untuk beroperasi di level itu," ujar Dwi.

Pihaknya sendiri akan terus membantu ExxonMobil untuk terus menambah produksi dan meningkatkan eksplorasi. Selama belum memperoleh persetujuan revisi Amdal, maka produksi minyak dari Lapangan Banyu Urip terpaksa diturunkan menyusul beroperasinya Lapangan Kedung Keris. Hal ini agar kegiatan operasi di Blok Cepu tidak melanggar Amdal yang ada.

Produksi minyak dari kedua lapangan baru dapat dioptimalkan setelah Amdal yang baru disetujui. Sehingga, pihaknya tidak dapat memastikan kapan Lapangan Kedung Keris mencapai puncak produksi. Meski demikian, produksi Blok Cepu disebutnya tidak lantas digenjot mencapai 235 ribu bph.

"Pada saat kami mengoperasikan [Blok Cepu] akan memperhatikan berbagai hal baik fasilitas, reservoir, dan lain sebagainya. Untuk running di 235 ribu bph, belum tentu. Kami harus perhatikan semuanya," ujar Dwi.

McKenzie menambahkan, proses pengajuan persetujuan Amdal masih berlangsung. Belum lama ini, pihaknya telah menggelar kajian teknis dengan Kementerian Lingkungan Hidup dan Kehutanan (KLHK). Selanjutnya pihaknya akan melaksanakan kajian masyarakat.

"Proses ini ada banyak tahapan, tetapi harapannya [Amdal] akan keluar dalam satu atau dua bulan ini," tutur dia.

Perkuat Daerah

Menurut Dwi, pengoperasian Lapangan Kedung Keris akan menghasilkan penghasilan kotor sekitar Rp 3,3 triliun per tahun. Namun tidak hanya itu, jika terus berjalan, pendapatan kotor ini juga akan memberi kontribusi pada kondisi ekonomi negara dan daerah. Selain itu, peningkatan produksi migas di wilayah Jawa Timur juga penting untuk memenuhi kebutuhan energi di wilayah ini. Pasalnya, industri di Jawa Timur tumbuh sangat tinggi.

Setelah Jawa Timur menjadi daerah produsen minyak terbesar di Indonesia, pihaknya juga akan turut menggenjot produksi gas di wilayah ini. Saat ini produksi minyak di wilayah ini mencapai lebih dari 25% produksi nasional.

"Kami sedang melakukan pengaturan agar dapat memenuhi kebutuhan gas di Jatim, ada proyek di Selat Madura. Maka kami tekankan untuk memenuhi kebutuhan Jawa Timur. Semoga tidak mengganggu investor di Jawa Timur," kata Dwi.

Kepala Dinas Energi dan Sumber Daya Mineral (ESDM) Jawa Timur Setiaji mengapresiasi dimulainya produksi minyak dari Lapangan Kedung Keris. Apalagi, pengoperasian ini mendongkrak produksi minyak di wilayahnya menjadi 305 ribu bph. Realisasi produksi tersebut mencapai sekitar lebih dari 30% dari produksi nasional.

Pihaknya berharap, jika memang masih ada lapangan baru yang bisa ditawarkan, perusahaan dapat menggarap lapangan migas tersebut. Hal ini untuk mendorong produksi migas di Jatim. Sebaliknya, pihaknya menjanjikan kemudahan bagi perusahaan migas.

"Barang kali ada perizinan dan Amdal baru, kalau ada kesulitan, kami mohon untuk dapat datang akan kami fasilitasi dan percepat," kata Setiaji.

Mengacu data SKK Migas, pada tahun ini, lifting minyak Blok Cepu ditargetkan sebesar 216 ribu bph. Sampai akhir September lalu, realisasi lifting minyak Blok Cepu tercatat telah melampaui target, yakni sebesar 216.011 ribu bph. Produksi minyak Blok Cepu ini naik dibandingkan realisasi sampai akhir tahun lalu sebesar 209 ribu bph.

Sementara itu, besaran cadangan yang dapat diproduksikan (recoverable reserve) di Blok Cepu saat ini tercatat mencapai 823 juta barel. Cadangan ini lebih tinggi dari yang awalnya diperkirakan dalam rencana pengembangan (plan of development/POD) sebesar 450 juta barel.

Investor Daily, Page- 9, Wednesday, Dec 18, 2019